{+Podcast} Breaking Stereotypes: What We Think vs. What We Know About Global Wealth Distribution

Pop Quiz: Which country group dominates the world economically today?

- A) Low-income countries (think rural economies and agricultural hubs)

- B) Lower-middle income countries (those “up-and-coming” emerging economies)

- C) High-income nations (traditional powerhouses like the US and Europe)

Many of you likely answered C—and you’d be partially right.

But here’s the twist: while high-income nations still hold economic clout, the real story is in the disappearing low-income group.

In 2000, over 30% of countries fell into the low-income category, but today that number has shrunk to just 11.9%.

Now here’s another one:

Which country do you think had the biggest leap forward in global income classification?

- A) China

- B) India

- C) Bangladesh

The answer?

All of the above.

Countries that were once pegged as symbols of poverty and underdevelopment have evolved dramatically over the last 20 years.

Their rapid climb up the income ladder isn’t just an economic win—it’s a signal that our outdated stereotypes about the world are overdue for demolition.

What the Data Really Tells Us

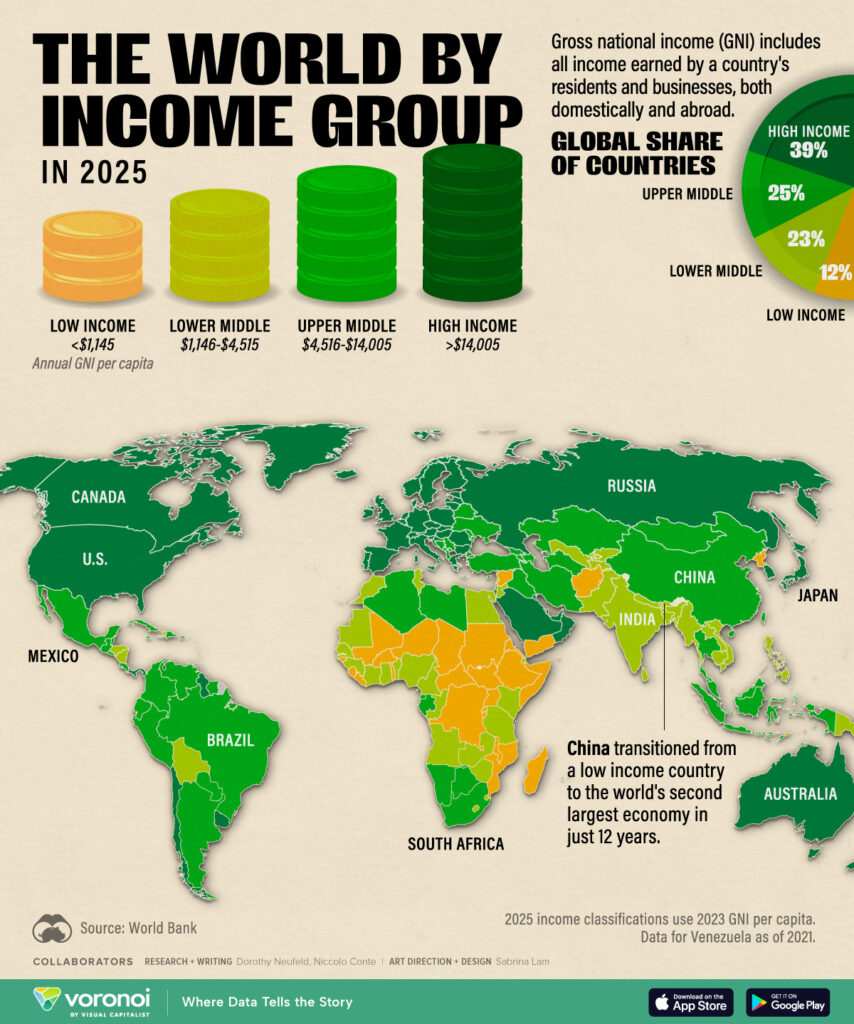

The latest charts from the World Bank’s income classification data reveal seismic shifts:

- Low-income countries: Once comprising 30.7% of the world in 2000, they now make up only 11.9%.

- High-income countries: Represent 39.4% of the world, still holding considerable influence but no longer untouchable.

- Middle-income nations: The real movers and shakers, occupying 48.6% of the global pie and often misunderstood or overlooked in global strategy.

We’ve all heard the narrative that countries like Bangladesh, Vietnam, or even Ethiopia are stuck in perpetual poverty.

But these charts tell us otherwise: many nations traditionally seen as dependent or weak are now formidable economic forces.

Why It Matters: Breaking Stereotypes at the Core

Let’s be blunt. The world of global economics has been mapped too often through old colonial lenses, with certain regions expected to stay poor and others expected to dominate indefinitely.

But this linear, stereotype-driven view is no longer valid—if it ever truly was.

Consider China. It was once classified as a low-income nation. Today, it leads innovation, manufacturing, and geopolitical strategy on the world stage.

Vietnam—often associated with war imagery and agricultural exports—is now a tech manufacturing hub. Bangladesh’s garment industry fuels its rise, but its digital transformation initiatives are equally notable.

These are not exceptions.

They’re part of a larger pattern.

Strategic Implications Moving Forward

What does this transformation mean for businesses, policymakers, and investors?

- New Markets Are Where the Action Is: For too long, business strategies have focused on saturated high-income markets in North America and Europe.But with the majority of global growth now stemming from middle-income countries, companies must rethink market entry and investment priorities.

- Example: Nigeria, despite its challenges, is on track to be an economic powerhouse. Companies ignoring sub-Saharan Africa may soon find themselves boxed out of major future markets.

- In my article Unlocking Africa’s Potential: The Coming Era of Opportunity, I discuss how Africa’s youthful population, expanding infrastructure, and booming entrepreneurial spirit are reshaping its global role. As I wrote there: “Africa is not a sleeping giant; it is a giant already on the move.”

- Don’t Assume Stagnation: Just because a country was poor yesterday doesn’t mean it will remain so tomorrow.

- Takeaway: Treat emerging markets not as charity cases but as strategic partners. Countries like Indonesia or the Philippines can surprise you with their innovation ecosystems.

- Infrastructure Investments Will Drive Next-Gen Growth: One reason behind this global upward mobility is infrastructure—ports, energy, tech access—all enabled by collaboration between governments and private sectors.

- Prediction: Watch for more strategic partnerships and investments in infrastructure-focused startups or green energy projects across middle-income regions.

- Tech Diffusion as an Equaliser: One key reason behind countries like Bangladesh and India moving up the ladder is technology. Access to global digital markets, remote work, and mobile payments has unlocked value faster than traditional economic models would predict.

- Implication: Businesses need to develop digital-first strategies for engagement with middle-income economies. An AI-powered app can penetrate markets faster than physical goods.

A Call to Action: Let’s Drop the Stereotypes

Stereotypes, whether in business or society, distort our view of reality. They blind us to opportunities and trap us in outdated narratives. Here are some myths we need to confront:

- Myth 1: Low-income countries are doomed to stay poor.

- Myth 2: Middle-income nations are just stepping stones to high-income status—they’re temporary by nature.

- Myth 3: High-income nations will always dominate global decision-making.

None of these are true.

In fact, relying on outdated beliefs is risky. Businesses that dismiss middle-income nations as “developing” or focus only on legacy markets will miss out on growth opportunities.

Governments and businesses that ignore these shifts risk irrelevance in strategic planning and policymaking.

What This Means for the Bigger Picture

Looking at income distribution isn’t just about GDP.

It’s about understanding a world and humans in flux:

- Social: Rising income brings shifts in consumption, urbanisation, and societal values.

- Political: Newly wealthy nations seek more influence on the global stage.

- Technological: Access to digital infrastructure accelerates knowledge transfer and productivity gains.

- Environmental: As countries grow wealthier, their environmental impact scales too—for better or worse.

This brings us back to the future.

If we’re to build meaningful strategies—whether as businesses, policymakers, or individuals—we must constantly challenge what we think we know.

We have to stop relying on comfortable labels and start engaging with facts and dynamic trends.

Final Thought: The Power of an Unbiased Mindset

Imagine a world where we didn’t assume anything based on stereotypes—where every nation, person, or market was assessed by what they are rather than what we think they should be.

Would we invest differently? Partner differently?

Build differently?

As we move forward, our ability to see the world as it is—not as it was or how we’d like it to be—will determine our future success.

In the words of my mother, “What’s between your ears shapes what’s between your hands.”

So, let’s leave stereotypes behind and build something smarter, more equitable, and, ultimately, better.

The world won’t wait for us to catch up.

Let’s Continue the Conversation

This shift in global dynamics isn’t just theory—it’s a practical call for businesses and leaders to adapt.

Whether through bespoke workshops, strategic keynotes, or one-on-one consultations, let’s explore how your organisation can benefit from understanding these changes.

Reach out to discuss tailored solutions that fit your industry and challenges.

For more insights into what wealth means to each generation and the global rise of wealth, listen to my segment on Hong Kong Radio 3 with Phil Whelan (16 minutes 50 seconds)

#GlobalEconomy #EmergingMarkets #BusinessStrategy #MorrisMisel #LeadershipForesight #FutureOfWork #GlobalWealth #StrategicPlanning #AfricaOpportunities #CEOStrategy #MiddleIncomeNations #EconomicGrowth